Growing the economy, creating jobs, and lifting stagnant wages are among the most important goals for American economic policy. From the end of World War II through the mid-1970s, wages tended to increase with productivity growth, and the labor market often operated at full employment. Since the mid-1970s, however, full employment has been far less common, and typical workers no longer tend to see their wages increase with productivity. At the same time, economic inequality is on the rise in the United States, and economists at the International Monetary Fund, or IMF, have found that high inequality is a negative drag on overall economic growth.

Public investments—such as education, public health, and infrastructure—are a fundamental element of any pro-growth budget that seeks to address the problems of slow growth, stagnant wages, and a lack of consistent full employment. Many public investments have a broad economic impact by enabling more Americans to participate in the economy and benefit from economic growth, such as when improved roads and transit systems connect workers to new job opportunities. In contrast, the failed trickle-down approach to economic growth focuses more narrowly on tax cuts for wealthy individuals or corporations in the hopes that these benefits will indirectly help everyone else.

Economic research confirms that a broad range of public investments work to grow the economy, but these varied positive effects are difficult to simulate in theoretical economic models. To clarify, an economic model is a set of mathematical formulas based on assumptions about how the economy works. While the formulas used in these models can simulate the generic effect of an increase in government spending, it is much more complicated to simulate what that government spending is actually doing.

Economic models are taking on an increasingly prominent role in the fiscal policy debate. New congressional rules require the use of economic modeling for some cost estimates—a process called dynamic scoring—and some tax analysts are using economic models to simulate the effects of tax proposals from presidential candidates.

The first step toward building a more pro-growth budget is understanding how federal programs actually affect the economy. The ultimate goal is to invest in sectors that promote shared prosperity. In 2015, the Center for American Progress proposed a comprehensive budget plan that substantially increases public investment. Unlike that budget plan, however, this issue brief is more narrowly focused on the first step—understanding the economic impact of government programs.

Organizations inside and outside the government are producing economic estimates that policymakers, reporters, advocates, and the public are using to understand and influence the budget debate. For both the producers and consumers of that fiscal analysis, this brief makes four recommendations to better utilize the economic research regarding public investments:

- Broaden the conception of public investment. In addition to the infrastructure, education, and research programs that are traditionally considered investments, new research is showing how other areas of the federal budget—including many safety net and regulatory programs—also can grow the economy.

- Consider different scenarios for aggregate demand. Many economic models assume that demand shortfalls never happen in the long run, which minimizes growth effects from policies that stabilize demand. A more realistic approach would be to consider a variety of possible scenarios for changes in demand.

- Examine how changes in revenue levels affect public investment. Economic analysis of tax policy should consider how changes in revenue levels affect public investments and other spending programs. Taxes exist to fund these programs, and analyzing tax policy without looking at the overall fiscal picture produces an incomplete result.

- Reject dynamic scoring. The first three recommendations would improve fiscal analysis, but they also demonstrate the inherent limitations of economic models. No set of mathematical formulas will ever provide a full picture of how the economy actually works, and dynamic scoring requires conclusions that are beyond the scope of any conceivable economic model. Budget scorekeeping is supposed to be a neutral way to compare the fiscal impacts of different proposals. Dynamic scoring inappropriately biases this process against programs that are hard to simulate in economic models, such as public investments.

These recommendations would broaden the scope of economic analysis, which should involve a wide range of economic research and models to consider the many different ways that public policy might affect the economy. Some types of research can be readily assimilated in a mathematical model, but other research might produce conclusions that do not lend themselves to modeling. Thorough economic analysis requires more than just a result from a model.

Dynamic scoring broadens the scope of budget scorekeeping to incorporate macroeconomic analysis, but budget scorekeeping can only accommodate a narrow form of economic analysis. Mathematical economic models are the only source for precise numerical results that can be added to cost estimates for legislation. Building these models requires making assumptions to artificially resolve or set aside issues where the economics literature lacks a quantifiable consensus. Narrowing macroeconomic analysis in order to fit it into the budget scorekeeping process results in a distorted economic framework that produces misleading conclusions about the fiscal and economic impacts of public policy.

This brief explains the economic basis for each of these recommendations, but one does not need to be an economic analyst to apply these recommendations. Political debates about taxes and spending are filled with economic claims about the costs and benefits of various policies, and anyone can use the questions raised in this brief to evaluate the quality and reliability of those claims.

Altogether, the recommendations in this brief show how public investments can build a stronger and more inclusive economy. Below is a look at each recommendation in greater detail.

Broaden the conception of public investment

Budget analysts traditionally consider infrastructure, education, and research to be public investments that promote long-term growth, in contrast to other government programs that support current consumption. One advantage of the traditional definition of public investment is that the federal government has collected data using this definition dating back to 1940, which enables consistent comparisons across time periods. The Office of Management and Budget, or OMB, however, notes, “The distinction between investment spending and current outlays is a matter of judgment.”

It is certainly true that infrastructure, education, and research are vital investments for economic growth, but the economic data make clear that the range of pro-growth public investments extends well beyond these three sectors. Economic analysis of the federal budget should incorporate these data to model the effects of government programs more accurately. The traditional definition of public investment is an important tool for understanding the federal budget, but it does not provide the full picture of how the federal budget can invest in the economy.

The economic importance of infrastructure, education, and research

The legislative branch’s Congressional Budget Office, or CBO, and the executive branch’s Office of Management and Budget both conclude that infrastructure, education, and research programs are public investments that can grow the economy over the long term.

Infrastructure programs that build the nation’s physical capital—such as transportation and water projects—are a textbook example of public investment. A 2014 study by the International Monetary Fund finds that “an increase in public infrastructure investment affects output both in the short term, by boosting aggregate demand … and in the long term, by expanding the productive capacity of the economy with a higher infrastructure stock.” In the case of transportation, this could mean that workers are connected to new job opportunities through infrastructure investments that make an unmanageable commute manageable. In contrast, underinvesting in infrastructure imposes high costs on the economy in terms of lost time and increased expenses.

While infrastructure investment focuses on the physical capital that the economy needs to function effectively, investments in education and scientific research focus on human capital and innovation. A recent study by the Washington Center for Equitable Growth found that investing in universal prekindergarten would deliver $8.90 in benefits to society for every $1 spent by increasing employment and education for parents, strengthening long-term economic prospects for children, improving public health, and reducing crime. Boosting high school graduation rates and investing in higher education increase future earnings of students, which also reduces the likelihood that they will need public assistance in the future.

Public investment plays a critical role in driving research and development, which is a key factor for long-term economic growth. An analysis of historical economic data found that technological development accounted for more than 50 percent of post-World War II economic growth in the United States and many other large industrialized nations. Cutting-edge industry leaders such as Google got their start with the help of federal research programs. In fact, many of the most significant innovations in recent years have been supported in part by the federal government.

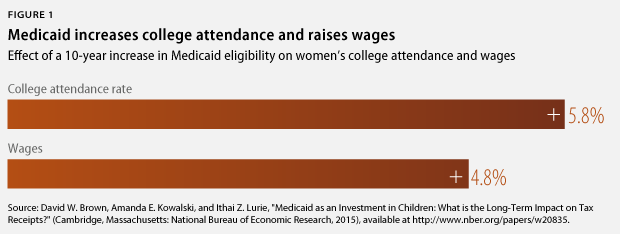

A recent CAP issue brief presents state-of-the-art economic research showing that many government programs not traditionally considered public investments boost long-term productivity by making children healthier. These include Medicaid, the Supplemental Nutrition Assistance Program, or SNAP—formerly known as food stamps—and various programs administered by the U.S. Environmental Protection Agency. These healthier children grow up to be more productive adults. Tax records reveal that children who became newly eligible for Medicaid due to expansions in the 1980s and 1990s were more likely to attend college than similar children who were not affected by these Medicaid expansions; these records also link childhood Medicaid eligibility to higher incomes in adulthood among women. Similarly, economic data collected since the passage of the Clean Air Act of 1970 and the establishment of the food stamp program in the 1960s and 1970s confirm that both public policies boosted long-run economic outcomes by improving childhood health.

Safety net programs pay dividends over the long term by enabling more people to fully participate in the economy as producers and consumers. The Earned Income Tax Credit, for example, provides cash directly to working families and is associated with positive health outcomes, higher test scores, and increased earnings in adulthood for children in families that receive the credit. A strong safety net helps workers overcome the inherent riskiness of changing jobs and moving into fields with higher wages. A 2016 study of state Medicaid rules used employment data to show that workers in states with generous Medicaid programs were more likely to transition to new jobs and move into fields with higher wages, while changes that reduced Medicaid eligibility made workers less likely to switch jobs and more likely to concentrate in lower-wage sectors.

More broadly, the Organisation for Economic Co-operation and Development, or OECD, found that an increase in “the gap between low income households and the rest of the population” tends to reduce economic growth in industrialized nations. Safety net programs are designed to shrink this gap, and the OECD concludes that “policies to reduce income inequalities should not only be pursued to improve social outcomes but also to sustain long-term growth.”

Efficient and effective regulatory enforcement also strengthens the economy by maintaining confidence, competition, and stability. A cross-country economic study concluded that antitrust rules increase economic growth, which is consistent with standard economic theory that monopolies reduce competition and make markets less efficient. The economic consequences of regulatory failures are most dramatically illustrated by the 2008 financial crisis that brought about the Great Recession. As with earlier financial crises around the world, the 2008 crisis was associated with a decline in financial supervision.

Economic analysis that considers defunding a regulatory agency only as a generic spending cut will not capture the most relevant risks. This is particularly relevant for financial supervision, since Congress is squeezing budgets at financial regulatory agencies. Ben Bernanke, a former chairman of the Board of Governors of the Federal Reserve System, concluded that the regulatory failures contributing to the 2008 financial crisis were not only the result of ineffective laws but also the failure of financial regulators to use the legal authorities they did have in the years leading up to the crisis. The nation now has more effective laws, but regulators need the resources to enforce those laws in order to reap their full benefit as an economic safeguard.

The assumptions used for economic analysis are particularly important for the CBO. This independent and nonpartisan agency provides budget data and projections, economic analysis, and cost estimates to Congress. The CBO’s economic analysis has become increasingly significant since 2015, when Congress began requiring the agency to include this analysis in official cost estimates for some types of legislation—a process called dynamic scoring.

In a June 2016 report, the CBO calculates an average rate of return on total federal investment, but this definition of investment is limited to infrastructure, education, and research. In the CBO’s view, public-sector investments tend to be three-fourths as productive as private-sector investments. The CBO also estimates that state and local governments reduce their own public investments by 33 cents for every $1 of additional federal investment—meaning that the ultimate increase in total public investment is two-thirds as large as the increase in federal investment. As a result, the CBO concludes that federal investments in infrastructure, education, and research deliver an average return that equals half of the average return on private investments, which is the result of multiplying three-fourths by two-thirds.

No single rate of return for public investments is going to provide much useful information for policymakers to evaluate the very different programs lumped into that single estimate. The CBO makes this abundantly clear, stating in its report on federal investment that the findings “should not be used to directly infer the effects of particular investment proposals.”

The CBO’s calculations on public investment and economic growth are based primarily on data from physical infrastructure investment—the sector that economists study most. The CBO notes that other sectors might also have investment benefits—such as public health—but that these links are “much less clear in the empirical literature.” But it is important to remember that having limited data on other sectors in no way suggests that programs within those sectors are not effective public investments. What’s more, new research suggests that environment, health care, nutrition, safety net, and regulatory enforcement programs can deliver significant economic returns, and the CBO says that it “continues to investigate the issue.”

A pro-growth budget should broaden the conception of public investment to improve long-term outcomes from federal programs. And if an economic model does not have the capacity to simulate some of these effects, acknowledging those limitations is critical to understanding what the model can and cannot conclude about the federal budget and the economy.

Consider different scenarios for aggregate demand

The first recommendation in this brief focuses on the supply side of the economy: how public investments can increase factors such as physical capital, human capital, and technology that determine how much the United States can produce. On the demand side, government programs can invest in the economy and promote growth by reducing shortfalls where productive resources—such as workers or factories—are left idle because of a lack of consumers to purchase their goods and services.

These demand effects are particularly significant for government programs that act as automatic fiscal stabilizers. These programs manage aggregate demand by either spending more or taxing less when the economy is struggling, which helps companies stay in business by enabling consumers to afford their products.

When legislation is proposed to modify automatic stabilizers, economic analysis should consider how the proposal’s impact on demand would affect the economy over the long term. While economists cannot predict future recessions, their models could employ sensitivity analysis to simulate different paths for aggregate demand, including hypothetical scenarios with future recessions.

The alternative approach—assuming that demand will always match supply in the long term—means assuming away any possible long-term economic benefits from automatic stabilizers. When the economy is running below its full potential due to low demand, the CBO states that policies to increase demand are particularly effective to grow the economy. When demand matches supply, however, demand-boosting policies may drag down long-term economic growth if they increase the national debt.

Safety net programs such as unemployment insurance, nutrition assistance, and Medicaid are particularly effective automatic stabilizers, since these programs are designed to provide the most benefit in times of severe economic distress, when people are most in need. In the case of nutrition assistance, for example, a study by Moody’s Economy.com estimated that every $1 spent on the Supplemental Nutrition Assistance Program during the Great Recession boosted gross domestic product by $1.73.

A 2014 paper by economists Teresa Ghilarducci and Joelle Saad-Lessler finds that many of the largest federal programs—including Social Security and Medicare—act as automatic stabilizers by “injecting more net household spending in recessions and dampening spending in expansions.” Social Security and Medicare support aggregate demand because they are large programs that do not lose value or pay less benefits during a recession—unlike private retirement accounts, which might shrink in a market downturn.

According to the CBO, the tax system is the federal government’s largest automatic fiscal stabilizer. Income tax collections rise and fall with changes in income, which is why the tax system raised so much less revenue during the Great Recession. This reduction in tax collections means that households have more disposable income to spend in the economy than they would under a tax system that always collects a fixed level of revenue. This effect is magnified by the progressive rate structure of the individual income tax, since households fall into lower tax brackets as their income declines, which means that they pay taxes at a lower rate.

Currently, the American economy is still experiencing a demand shortfall. In the long term, however, many economic models—including the model that the CBO uses—assume that demand will eventually rise to match the supply of goods and services that the economy could produce if it were operating at its maximum sustainable potential. Automatic stabilizers have a minimal impact in long-term CBO projections since the CBO assumes the economy will always remain near its full potential, which means that the CBO’s economic analysis of legislation to change automatic stabilizers may fail to consider how such policies will affect the economy in future recessions.

Recent research by economists Lawrence Summers, Brad DeLong, and others suggests that chronic demand shortfalls may become more frequent. Various economic shifts are causing increases in savings, but a lack of productive investments to make use of those savings leads to financial bubbles and a lack of adequate demand to sustain strong economic growth. Increasing economic demand would create more opportunities for productive investments—more demand means more customers—and Summers’ research strongly advocates for increasing public investment to boost demand and grow the economy.

In addition to the cyclical changes in demand that accompany recessions, economic models also should consider the possibility that potential supply could fall over time to match a persistently low level of demand. This is one aspect of secular stagnation, and it could be a long-term structural problem for the economy. Estimates of potential supply have indeed fallen significantly in recent years, and the CBO consistently attributes some of these downward revisions to factors that are consistent with secular stagnation, as described in the CBO’s 2016 budget and economic outlook:

Potential labor hours will be lower because persistently weak demand for workers since the recession has led some people to weaken their attachment to the labor force permanently. For example, some people who left the labor force after experiencing long-term unemployment are not expected to return to full-time, stable employment over the next decade.

While the CBO recognizes the role of persistent demand shortfalls in its downward revisions of potential output, its economic model does not account for the possible effects of a continued secular stagnation. Economic models that assume demand will rise to match potential supply cannot evaluate how changes to fiscal policy will affect an economy in secular stagnation because this assumption implicitly rejects the secular stagnation hypothesis.

Examine how changes in revenue levels affect public investment

Taxes are a part of the overall fiscal system, and tax policy should be considered within this larger context. If a proposed tax policy increases deficits, economic models should measure the economic impact of both taxes and deficits. If a budget plan uses unspecified spending cuts to pay for tax cuts—requiring analysts to make assumptions about which programs are cut—the economic model should also include effects from reduced levels of public investment. Economic analysis of tax policy should consider how changes in taxes and spending will affect aggregate demand in a range of possible scenarios, especially since the federal tax system is a major automatic stabilizer.

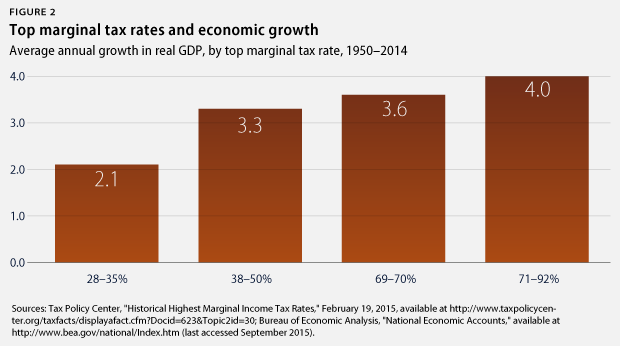

Economic analysis of tax policy is subject to considerable uncertainty. While some models assume that tax cuts spur economic growth by encouraging more work or investment, analysis of the economic record calls this assumption into question. Looking at the data on the American economy since World War II, there is not a positive relationship between top income tax rates—including top tax rates for investment income—and economic growth.

A report by the Congressional Research Service, or CRS—an independent and nonpartisan agency within the Library of Congress—found that “the reduction in the top tax rates have had little association with saving, investment, or productivity growth.” The report was supported by the heads of the CRS economic team but withdrawn after protests by Senate Republican leaders. Other studies that examined large tax cuts enacted under Presidents Ronald Reagan and George W. Bush also found that tax cuts failed to stimulate growth or investment.

Adding further complication to tax analysis, changes in federal revenues have to correspond to changes in spending levels, changes in deficits, or some combination of the two. Economic analysis of tax policy should not take place in a vacuum that does not consider how revenues affect spending and deficits.

Recent analysis by the Tax Foundation, for example, illustrates the pitfalls of modeling taxes in isolation. The Tax Foundation explains, “Our model is essentially built around the assumption that the tax system proposed is sustainable and permanent.” The Tax Foundation recently acknowledged that this assumption creates problems for its conclusions about some recent tax proposals, but the underlying flaw is far broader in scope. Although the United States is not facing a looming debt crisis, the federal government’s current fiscal path is not sustainable over the long term, so the assumption at the core of the Tax Foundation’s model does not even describe the status quo.

The economic story changes when tax policies are not analyzed in a vacuum. A review of the evidence by economists William Gale and Andrew Samwick, for example, concludes, “Long-persisting tax cuts financed by higher deficits are likely to reduce, not increase, national income in the long term.” The effect of revenue changes that correspond with spending changes is not as clear. Gale and Samwick cite simulations showing positive growth effects from tax cuts that are financed by spending cuts, but note that their analysis assumes that none of the spending cuts affect public investment.

Given the broad range of public investments in the federal budget, it is not realistic to assume that large tax cuts financed by spending cuts will have no effect on public investments. Even looking only at the sectors traditionally considered to be public investment, the CBO reports that the federal government spent $293 billion on nondefense infrastructure, education, and research in 2015, which was 8 percent of total federal spending. These public investment totals do not include other federal programs proven to increase long-term productivity, such as Medicaid, nutrition assistance, and environmental protection. And federal programs that stabilize aggregate demand comprise a large share of the budget—Social Security and Medicare alone accounted for about 39 percent of federal spending in fiscal year 2015.

This does not mean that every dollar of federal spending is used efficiently or that policymakers should avoid cutting any programs. In the health care sector, for example, CAP recommends many reforms to increase efficiency and reduce federal spending. But the economic impacts of tax and budget plans that reduce spending should be evaluated based on realistic outcomes from policy changes rather than the assumption that spending can be dramatically lowered without any economic consequences.

Reject dynamic scoring

The preceding three recommendations would make economic analysis more realistic, but they also show the inherent limitations of economic modeling. Better models would help inform policy choices regarding public investments, the federal budget, and economic growth, but dynamic scoring goes too far by expecting more than any economic model can possibly deliver. No set of mathematical formulas will ever fully reflect how public policy affects the economy. This is especially true for public investment.

Economic models will always carry an implicit bias against whatever programs do not fit into the model. Dynamic scoring brings this bias into budget scorekeeping, which is supposed to be a neutral process for measuring fiscal costs and benefits. Even if a model can accurately simulate the growth effects of some policies, using this model for cost estimates creates a bias against programs where the growth effects cannot be accurately simulated.

While the assumptions underlying economic models of tax policy are subject to considerable uncertainty, in many cases, simulating the effects of government spending in economic models may not even be possible. In the case of national defense, for example, it is hard to imagine how a model would simulate the effect that reducing U.S. naval presence might have on the security of global shipping and international trade. Or closer to home, the grocery industry recognizes the importance of effective food safety programs to maintain consumer confidence in its products, but this cannot necessarily be translated into a mathematical parameter that fits into an economic model.

For the many different federal programs that might be considered public investments, a rigorous economic model would have to include impacts covering vastly different areas. This would require formulas and assumptions to simulate the effects of investments as varied as building a highway, providing college scholarships, curing a disease, feeding hungry children, or reducing pollution.

Furthermore, while some of the benefits from public investments are quantifiable for the purposes of a mathematical model of the economy—such as higher incomes—other benefits are less easily quantified into simple economic terms, such as the benefit of a healthier population. The CBO’s report presenting its dynamic score for legislation repealing the Affordable Care Act, or ACA, for example, does not include any economic impact due to the public health consequences of an additional 24 million Americans without health insurance. The CBO report discusses the possible economic benefits of a healthier workforce but ultimately concludes that there is insufficient evidence to measure and include this effect in its model. It should be noted, however, that the CBO still concludes that repealing the ACA would increase the deficit, regardless of whether dynamic scoring is used.

A dynamic score might seek to avoid these complications by using an overall return on all public investments. As described above, however, this approach ignores actual outcomes from government programs and excludes economic benefits from programs not counted in the model’s definition of public investment. Dynamic scoring also reflects the results of only one prediction for the path of demand in the economy, which means that it cannot reflect the range of possible outcomes from future recessions or secular stagnation. Finally, the single, precise result produced by dynamic scoring provides a false sense of accuracy that masks the highly uncertain assumptions that are required to produce any economic model.

That does not mean economic models have no use for understanding fiscal policy, but it does limit the conclusions that they can offer to policymakers. Dynamic scoring requires economic models to reach conclusions beyond their scope. Budget scorekeeping is supposed to be a neutral yardstick against which the fiscal costs or savings from various proposals can be measured and then weighed against other costs and benefits. When dynamic scoring reduces the fiscal cost of some policies by measuring their economic growth impacts, it creates a bias against other policies where there may be substantial economic benefits that cannot be simulated accurately in a model.

Congressional rules are not carved in stone, and the new dynamic scoring rule established by the FY 2016 congressional budget resolution only applies to the 114th Congress. The composition of the House of Representatives and the Senate will change in the next Congress. Each chamber can decide for itself whether to use a dynamic score for official scorekeeping purposes.

Instead of skewing budget analysis with dynamic scoring, lawmakers should consider a wider range of credible economic analysis when evaluating legislation. The conclusions from this economic analysis should be considered among the other costs and benefits that lawmakers weigh against the fiscal impacts of legislation. Official cost estimates should not include the highly disputed and uncertain conclusions that are required by dynamic scoring.

Conclusion

Anyone can use the recommendations in this brief to question the assumptions made by economic models that estimate the effects of taxes and spending. For instance, does the model include public investments? What programs count as investments? Does the model use empirical studies, such as those evaluating Medicaid and antitrust enforcement, to simulate rates of return from public investment? What assumptions does the model make about aggregate demand? If the model is simulating a tax plan, does it also consider effects on spending and deficits? What alternative assumptions should the model consider to evaluate the full range of possible outcomes?

Economic studies using empirical data demonstrate that a wide range of federal programs expand opportunity and include more Americans as full participants in the economy. Rather than making assumptions that set aside these findings, economic analysis should help policymakers and the general public understand how to better utilize public investments to raise wages, reduce inequality, promote full employment, and grow the economy.

Harry Stein is the Director of Fiscal Policy at the Center for American Progress.

The author would like to thank former Economic Policy team intern Bence Borosi, whose initial research on public investment helped inform this brief. The author is also grateful for the insightful comments and suggestions from Jared Bernstein of the Center on Budget and Policy Priorities; William Gale of the Brookings Institution; and CAP’s Christian E. Weller, Andy Green, Alexandra Thornton, Carmel Martin, and Marc Jarsulic. This brief was greatly improved as a result of their feedback, and any errors are the sole responsibility of the author.